The impact of using the Balanced Scorecard – Statistics and Results

The Balanced Scorecard emerged in the early 1990s as a new management concept and was immediately embraced by both academics and corporate world (Denton 2005, de Wall 2003, and Bourne 2008). Since then, the potential of this new concept was recognized in various forms, receiving distinctions as the best theoretical framework in 1997 from the American Accounting Association (Norreklit, 2003), while the Harvard Business Review considered that the Balanced Scorecard was one of the most influential ideas of the twentieth century.

According to de Wall (2003) the Balanced Scorecard is the most successful tool in the field of performance management. The uptake of the Balanced Scorecard in a relatively short period of time is quite impressive. According to Bain & Company by 2002 the Balanced Scorecard was already used by half of the Global 1000 companies (Calabro, 2001). A 2008 survey performed by Lawson et al (2008), cited by Norton (2010) in one of its articles from Balanced Scorecard Report found that 62% of organizations used the BSC and strategy maps as their organization framework while only 13% relied on Total Quality Management (TQM) and 3% on Shareholder Value.

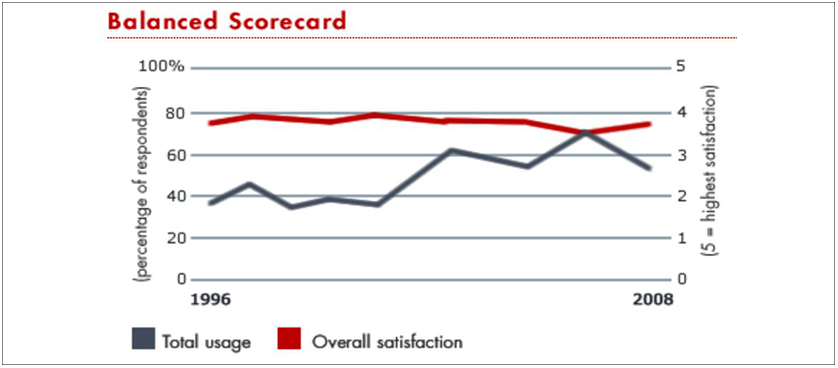

Perhaps the most comprehensive evaluation of the global Balanced Scorecard adoption is given by the “Management tools and techniques” survey, administered annually by Bain & Company. Balanced Scorecard was introduced in the survey in 1996, when 39% of the respondents claimed to be users. For about five years this figure remained fairly constant, and then it picked up at 62% in 2002. Overall the Balanced Scorecard is considered one of the tools with the sharpest increases since being introduced in the survey, with an 18% change, although its usage dropped slightly in 2004 at 57%, and to 53% in 2009 as the latest Bain & Company survey reveals. Despite the high ratings and increased attention, as well as the idealistic scenarios that are presented in the Balanced Scorecard literature, the promises of the concept have yet to convert in widespread success in practice. While there are good evidence about widespread adoption, user satisfaction and executives’ perception, empirical and quantifiable evidence of the Balanced Scorecard effectiveness in creating organizational value is scarce. Currently, there are only few academic studies that test the success of the Balanced Scorecard implementation and its impact on organizational performance.Perhaps, the most conclusive one performed by Crabtree and DeBusk (2008) shows that firms who adopt the Balanced Scorecard significantly outperform firms that do not adopt the BSC over a three years period, beginning with the year of adoption.

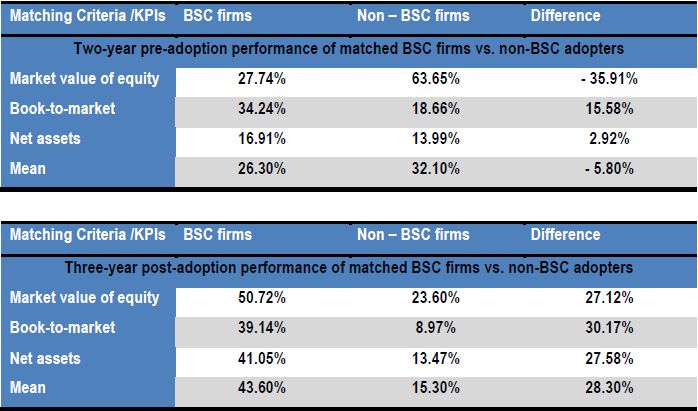

The study took in consideration 57 BSC companies and 107 non-BSC companies and compared the results of these companies on three important Key Performance Indicators or criteria, two years pre-adoption and three -year post-implementation of the BSC framework.

As the results show, over the three year post-adoption period, BSC adopters outperform their non adopters counterparts by 27 – 30 points, while the mean difference on the cumulative criteria between the two-year pre-adoption results and three-year post-adoption results is even more significant, over 34 points.

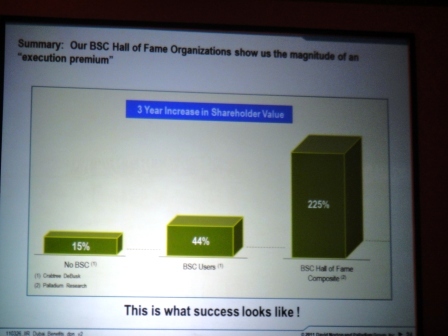

Another study performed by Palladium Research Team and cited by David Norton during the delivery of its Master Class at Balanced Scorecard Forum Dubai shows that companies using the Balanced Scorecard System create dramatically higher levels of shareholder value for organization over a three years period. BSC Hall of Fame Organizations declare in average a 225% increase in shareholder values compared with only 15% for non-BSC organizations.

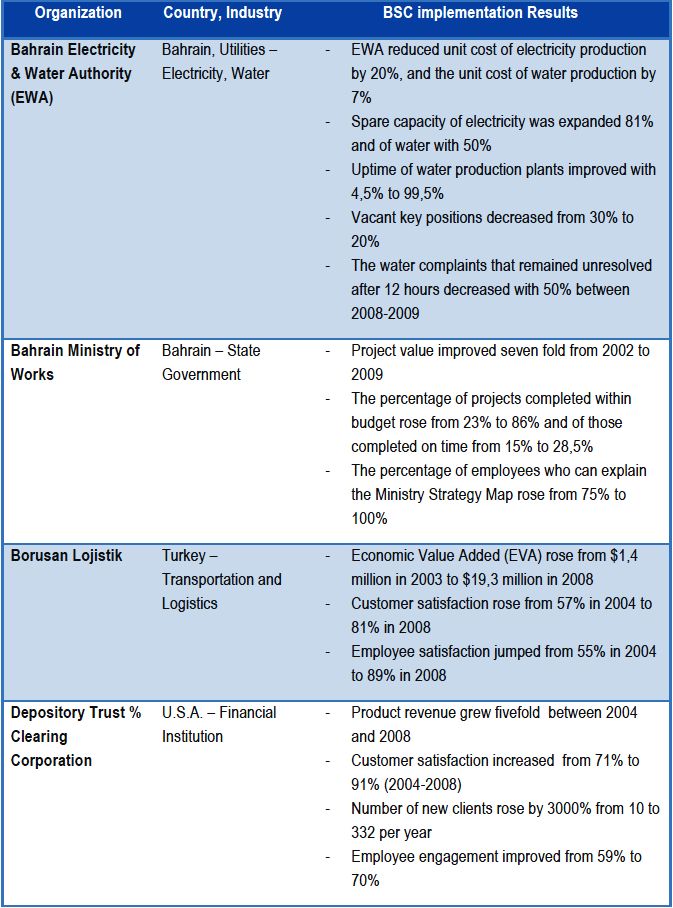

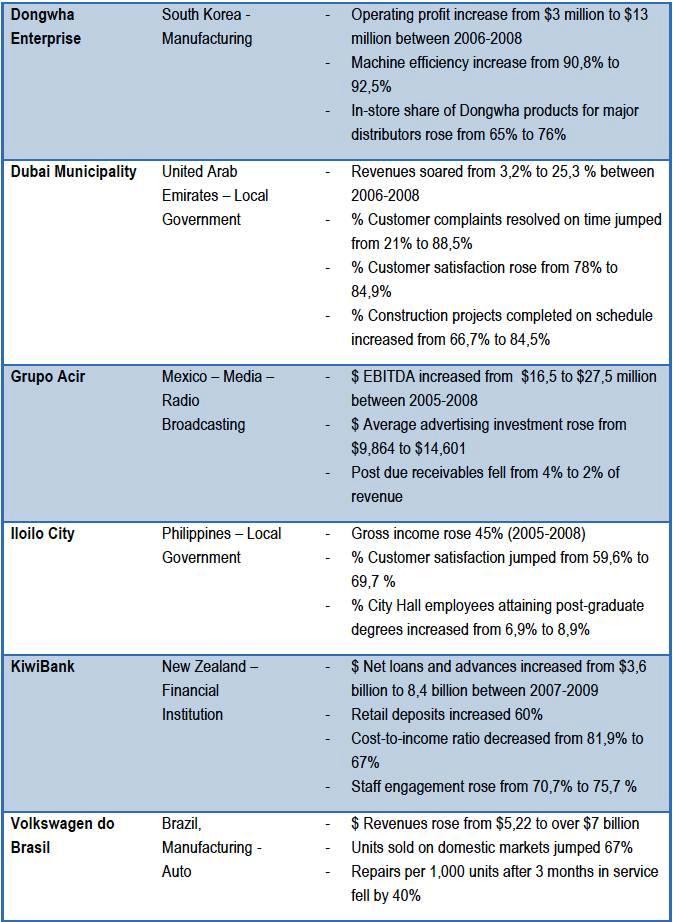

A recent Palladium Balanced Scorecard Hall of Fame Report (2010) shows consequently significant improved results for 13 new organizations included in the BSC Hall of Fame. Several of these companies’ BSC implementation results are summarized below.

For additional resources on Balanced Scorecard theory and practice access BalancedScorecardReview.com.

References

- Balanced Scorecard Forum, Dubai (2011), Dr Robert Kaplan & Dr. David Norton Master Class, 27-28 March 2011, Hyatt Regency and Galleria, Dubai

- Bourne, M. (2008) – Performance measurement: learning from the past and projecting the future. Measuring Business Excellence, Vol. 12, No 4, pp 67-72

- Calabro, L. (2001), How to make your scorecard effective, Strategic Finance, June 2001, pp 19, CFO, February 2001, Vol. 17, No. 2, pp 72

- Crabtree, A & DeBusk, G. (2008), The effects of Adopting the Balanced Scorecard on Shareholder Returns”, Advances in Accounting, incorporation Advances in International Accounting, Vol. 24, pp 8-15

- Denton, K.D. (2005), Professional Practice: Measuring relevant things, International Journal of Productivity and Performance Management, Volume 54, Issue 4, pp. 278-287

- De Wall, A. (2003), The future of the balanced scorecard. An interview with Professor Robert Kaplan,Measuring Business Excellence, Volume 17, Issue 1, pp. 30-36

- Norreklit, H. (2003), The Balanced Scorecard: what is the score? A rhetorical analysis of the Balanced Scorecard, Journal of Accounting, Organizations and Society, Vol. 28, pp. 591-619

- Norton, D (2010), A Platform for Strategy Management, Balanced Scorecard Report, Vol. 12, No. 4, pp 1-7

- Palladium (2010), Strategy Execution Champions, The Palladium Balanced Scorecard Hall of Fame Report 2010, Harvard Business Publishing

- Bain & Company, 2009

- Crabtree & DeBusk, 2008

- Balanced Scorecard Forum, Dubai 2011

- Palladium, 2010

Tags: David Norton, KPI, Performance Management, Scorecard