Measuring company profitability with the Berry ratio

Companies use profitability ratios in order to measures their ability to generate returns through effective allocation and use of available resources. KPIs in this area have often as main component profit or return. One of the most popular profitability ratios is the Berry ratio.

It was developed by Dr. Charles Berry (1930-2007), a specialist in industrial organization and applied microeconomics and professor at the Princeton University, in conjunction with a tax court case involving transfer pricing between a U.S. parent company and a foreign subsidiary. He consulted with dozens of government agencies, corporations and law firms on antitrust and regulatory matters, transfer pricing and corporate taxation before launching the ratio that carries his name.

It was developed by Dr. Charles Berry (1930-2007), a specialist in industrial organization and applied microeconomics and professor at the Princeton University, in conjunction with a tax court case involving transfer pricing between a U.S. parent company and a foreign subsidiary. He consulted with dozens of government agencies, corporations and law firms on antitrust and regulatory matters, transfer pricing and corporate taxation before launching the ratio that carries his name.

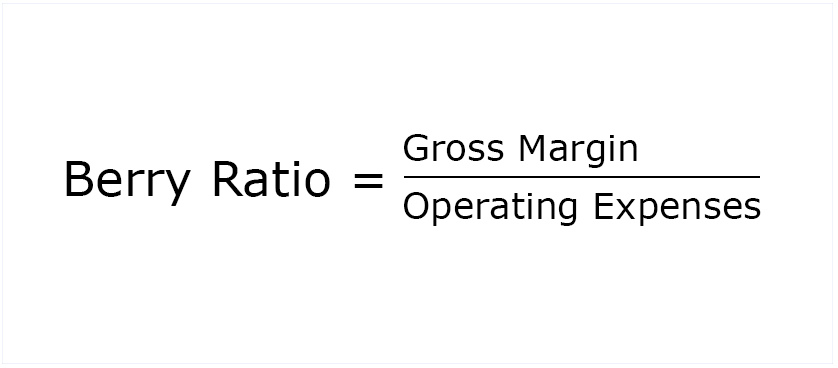

The Berry ratio measures the ratio of a company’s gross profits to operating expenses and is used mostly by tax and transfer pricing analysts.

It is calculated by dividing $ Gross margin (which is basically the difference between $ Sales and $ Cost of goods sold) to the $ Operating expenses.

A ratio coefficient of 1 or more indicates that the company is earning a profit over and above its variable expenses; a coefficient below 1 indicates that the firm is losing money. Although the Berry ratio is a simple profitability measure, it is probably one of the most misused ratios in analysis of transfer pricing. Due to failure in understanding its limitations, errors in interpreting it may appear. The Berry ratio cannot be applied to distributors that also perform manufacturing functions as it cannot capture the additional return earned by the manufacturing function.Empirical studies have shown that distributors with low operating expense intensity (less than 10%-15% relative to sales ratios) show very high values of the Berry ratio when compared with distributors with higher operating expenses. Thus, an extra caution should be taken when comparing two distributors with a large gap between their operating expense intensities.

Using the Berry ratio together with other profit level indicators will provide a higher level of validity of the information.

Additional resources

- smartKPIs.com library of KPIs: Finance > Profitability > # Berry ratio

- Przysuski, M.,Lalapet, S. (2005), “A comprehensive look at the Berry Ratio in transfer pricing”, Tax analyst, Volume 40, Number 8, Reprinted from Tax Notes Int’l, November 21, 2005, p. 759

- Stevens, R. (2007), “Charles Berry, economist and ‘dedicated University citizen,’ dies”, Princeton Weekly Bulletin September 16, 2007, Vol. 97, No. 1

Tags: Finance performance, Performance Measurement, Retail performance