KPI of the Day – Investment: % Final bid against published offering

Definition

Measures the final bid as a percentage of the published offering.

Get the opportunity to grow your influence by giving your products or services prime exposure with Performance Magazine.

If you are interested in advertising with Performance Magazine, leave your address below.

Measures the final bid as a percentage of the published offering.

Measures the amount of administrative expense as a percentage of the gross premium.

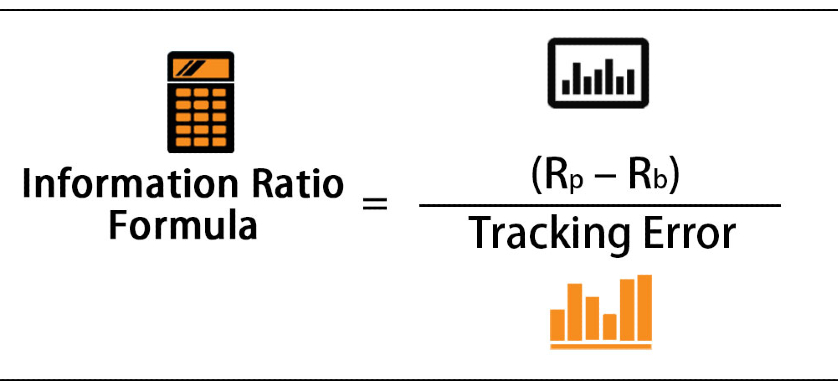

Measures the part of the rate of return attributable to the portfolio manager’s ability to generate excess returns relative to a benchmark.

Measures the investor attitudes toward the market, by using the Nova and Ursa funds from the Rydex Fund Group.

Measures the relationship between return relative to drawdown (downside) risk in a hedge fund.