KPI of the Day – Investment: # Treynor ratio

Definition

Measures a portfolio’s return earned in excess of what would be earned on a risk-free investment.

Get the opportunity to grow your influence by giving your products or services prime exposure with Performance Magazine.

If you are interested in advertising with Performance Magazine, leave your address below.

Measures a portfolio’s return earned in excess of what would be earned on a risk-free investment.

Measures the performance of a stock portfolio relative to its risk.

Compares the trading volume of put options to the trading volume of call options.

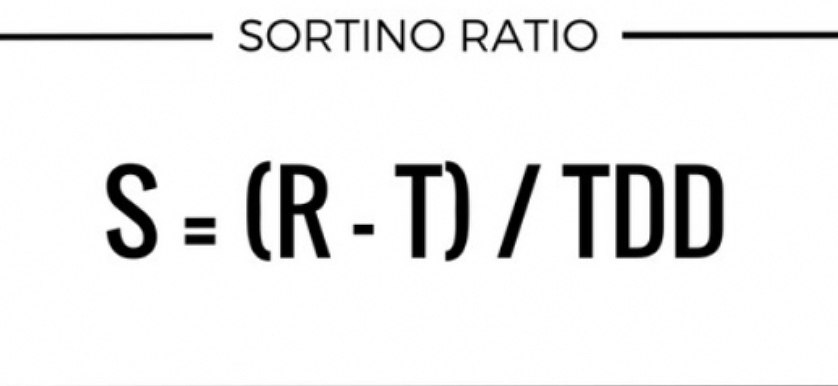

Measures the risk-adjusted return of a security or fund’s performance, without penalizing it for upward price changes.

It represents the Sharpe ratio, in the context of assets that are not normally distributed (i.e. portfolio is composed of hedge funds, high yield bonds etc).