Do ESG Strategies and Performance Measurement Truly Matter to Sectoral Investors?

Image Source: Freepik

Impact investors aim to achieve measurable financial returns while maintaining positive social and environmental impacts. Recent empirical research has shown that value investors consider Environmental, Social, and Governance (ESG) practices in their investment decision-making processes, although the emphasis on these indicators varies across industries.

However, impact investing is not a new concept. In fact, it could be traced back to 1928 when the first screened investment fund was established in the United States. As environmental awareness grew, the concept of responsible investing gained more traction within the investment community. This trend continued to evolve until the rise of Stakeholder Capitalism Theory in the 1950s and 1960s, which advocated maximizing value for all stakeholders, including customers, employees, suppliers, and local communities.

During the ’60s and ’70s, socially conscious investors began avoiding funds with investments in industries like tobacco or weapons. Presently, many companies are embracing balanced performance goals known as the Triple Bottom Line (TBL). Some investors are even willing to pay a premium for companies demonstrating positive ESG impacts, indicating a growing preference for environmentally and socially responsible investments.

Read More >> ESG’s Impact on Business: Driving Organizational Performance and Beyond

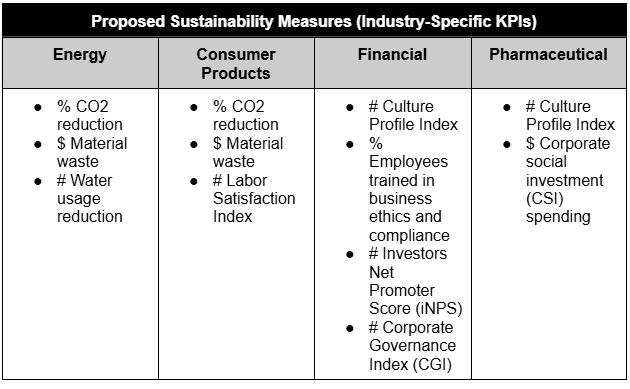

Given the varying ESG priorities across sectors, there is no one-size-fits-all strategy or performance measures to be adopted by companies that want to attract and retain value investors and their equity capital. To illustrate this, former Forbes staff writer Kathryn Dill said, “Certain indicators are prioritized over others across industries. For example, safety rankings are not particularly important to banks, as the financial sector work doesn’t pose physical danger. But safety performance is an important measure of sustainability in the transportation industry, where physical well-being can be at stake”. Henceforth, strategists and performance management professionals may need to emphasize specific aspects of ESG based on their investors’ preferences, as shown in the figure below:

Fig. 1 Proposed Sustainability Measures (Industry-Specific KPIs)

Energy Sector: Due to the energy industry’s inherently high carbonated emissions and the amount of waste generated and water used, strategists within this sector should focus on initiatives related to lowering CO2 Emissions, material use, waste production, and water usage. To measure this, they may use KPIs such as % CO2 reduction, $ Material waste, and # Water usage reduction, respectively. In this regard, the environmental aspect of ESG takes precedence.

Consumer Sector: Similar to the energy sector, there is an emphasis in the consumer sector related to reducing emissions, material use, and waste production as part of the environmental dimension of ESG. However, this is in addition to the need for further focus on decent labor practices—falling under in the social dimension of space of their ESG strategy—which could be measured using the # Labor Satisfaction Index.

Financial and Insurance Sectors: In these sectors, organizational culture, diversity, and inclusion matter with regards to the environmental dimension. Meanwhile, governance structures, advocacies, and business ethics matter in the governance dimension. The potential KPIs used in these industries may include: # Culture Profile Index, % Employees trained in business ethics and compliance, # iNPS, and # CGI.

Pharmaceutical and Medical Sectors: Strategists in these sectors need to worry about community impact and labor practices, which fall under the social dimension. They must also focus on business ethics in the governance dimension. Candidate KPIs here may include # Culture Profile Index and $ CSI spending.

All the strategic themes and underlying indicators proposed above should only be considered guides at best. A better approach is for companies to communicate with their communities and involve stakeholders in their policies, decisions, and operations to cultivate a fully supportive investment strategy implementation system.

Read More >> Lessons From Internal Scanning: The Impact of Leadership on Organizational Climate

In conclusion, performance management professionals should collaborate closely with strategists to align sustainability objectives and KPIs with strategic initiatives through cascading and appropriate KPI selection techniques, regular measurement frameworks such as the strategic scorecard, and implementation of performance improvement best practices such as regular performance review meetings which are all crucial to ensure that the company remains on track with its sustainability goals relevant to today’s investment community.

**********

About the Author

Tarig Malik is a seasoned Strategy and Performance Management Professional with extensive expertise in enhancing strategic, operational, and individual performance. Holding multiple certifications (SPP, C-BSC, C-OKR, C-KPI), Tarig leverages a strong academic foundation and practical experience to drive continuous improvement and foster a performance-oriented culture across various organizations.