The Role of Governance in Strategy Implementation

One of the most important factors in running a successful business is strategy implementation, where general, strategic objectives are translated into precise activities that involve bringing ideas to fruition. Operational performance is used to measure the effectiveness and efficiency of these activities in achieving strategic goals and objectives. Meanwhile, governance provides the structure and rules needed to monitor performance and achieve objectives, which requires good planning, resource allocation, and management.

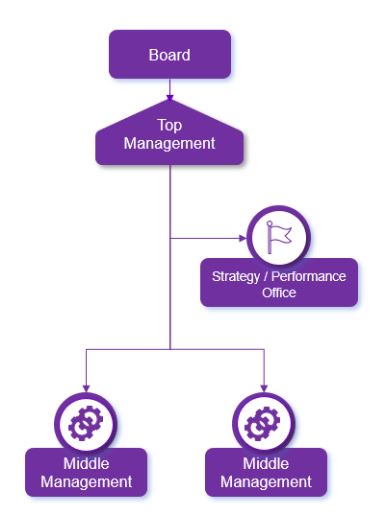

Governance mechanisms are critical to guiding, monitoring, and improving strategy planning and execution. Roles and accountabilities should be clear: the board of directors sets the company strategy, goals, and overall direction. Top management ensures the strategy is translated and cascaded to the lower managerial levels. Middle management is critical to ensure the implementation of strategic objectives.

Upon receiving clear direction from the top management, middle managers should also set clear responsibilities and metrics. Metrics should be set to monitor success impartially. Clear roles and their coordination could also be ensured by appointing a strategy/performance office responsible for overseeing the strategy process, contributing to setting strategic objectives, and coordinating performance measurement.

Organizational Hierarchy | Source: The KPI Institute – C-KPI Course

The purpose of governance is to ensure that an organization continuously fulfills its mission by coordinating its strategy with its operational goals, procedures, and standards. Procedures and processes are essential to the success of an organization, as these help ensure that resource allocation is done properly, with all stakeholders having a clear role in how the organization’s objectives are achieved. In the case of a company where multiple projects run at the same time in various areas, this is especially important. Confusion, overlap, and miscommunication may arise in these situations, therefore, clear rules, guidelines, and accountabilities should be set up.

Read More >> Two sides, same coin: using divergent and convergent thinking in strategy planning

Reliable, comprehensive financial and non-financial information is at the core of governance, as it serves decision-making. Reporting procedures are crucial to ensure the right processes are set up to disclose the necessary data to the stakeholders, with mechanisms for regular reporting to share performance data and progress updates. Performance reporting is important as it disseminates information, communicates progress, forecasts progress, and updates status to stakeholders.

Moreover, decisions are taken based on the information received, and an organized process for review and decision-making, such as regular strategic review meetings or performance review sessions could be implemented. Periodic performance reviews measured against objectives should be conducted to analyze gaps, identify areas for improvement, and initiate corrective actions.

Governance cannot be properly implemented without the adequate behaviors of people.

Since emotions play a large role in shaping behavior, it becomes all the more crucial for leaders to facilitate buy-in from the organization. Leaders should provide trust, guidance, and direction, instilling the necessary behaviors that support the organization’s objectives. Communication should be clear and consistent to provide clear direction.As resistance is natural given the fear of the unknown or the perceived negative changes, it is important to address employee concerns and provide support. Some of the potential barriers are removed when support is provided to ensure that employees understand the strategy, their roles, and how their performance contributes to strategic objectives.

Read More >> The power of change management in strategy execution

In conclusion, governance is indispensable for an organization’s success and reputation. By establishing clear structures, processes, and accountability mechanisms, governance ensures that the company operates in alignment with its objectives, values, and legal obligations. It provides a framework for effective decision-making, safeguarding the interests of shareholders, employees, customers, and other stakeholders. To summarize, governance isn’t merely a corporate formality—it’s the cornerstone of organizational excellence and trust in the modern business world.

For more in-depth articles about strategy, click here.

**********

Editor’s Note: This article was first published on May 8, 2024 and last updated on September 17, 2024.