Social audits for MicroFinance Institutions (MFIs)

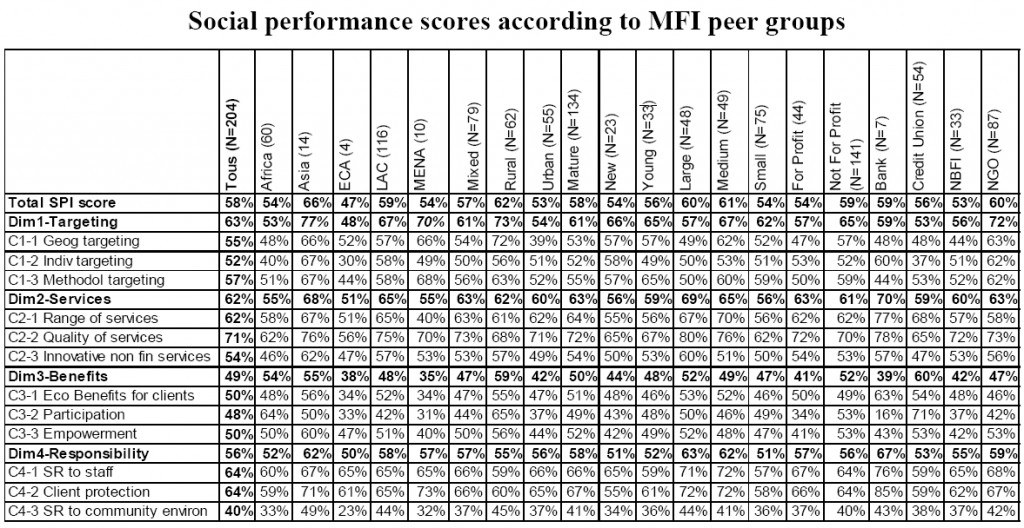

In a recent report, CERISE (Comité d’Echanges, de Réflexion et d’Information sur les Systemes d’Epargne-crédit) presents the progress of social performance assessment during the past few years, being influenced by social audits, social ratings and reporting standards. The analysis is based on the results of 287 Social Performance Indicators (SPI) audits from 223 institutions in 53 countries, therefore the database gathered presents a highly important potential for taking stock of the social dimension of microfinance practices worldwide.

The report indicates that:

- MFIs score highest on targeting and outreach (63%), this being the main objective of MFI. The lowest score is registered by the economic and social benefits MFIs provide to their clients (49%).

- The quality of service is highly rated, meaning that MFIs pay a close attention to their clients’ needs. However, it is hard to establish objective indicators that are also standardized and verifiable.

- From a geographic point of view, rural MFIs tend to overcome difficulties from their operating areas by developing participatory governance models and strong adaptation of services, generating efforts towards social responsibility.

- NGOs have strong targeting strategies, while banks appear to focus on diverse product mix and solid social responsibility policies. For the NGOs, the measures in favor of consumer protection are linked with lower portfolio at risk (Bédécarrats, Lapenu & Tchala, 2010).

Social performance auditing has become very important for microfinance industry as donors and social investors require a higher degree of accountability from their MFI partners. According to the report, social performance becomes more important every year, being included in the MFI strategy, along with financial and environmental aspects.

References:

- Bédécarrats,F, Lapenu, C & Tchala, R, Z 2010, Social audits in microfinance: what have we learned about social performance?

Photo Source:

- Wise Geek

- Bédécarrats, Lapenu & Tchala (2010)

Tags: Finance performance, KPI, Microfinance Institutions, Performance Measurement