Social and Financial Performance of Microfinance Institutions

Microfinance institutions (MFIs) are mainly private-held companies, whose owners tend to have long-term interests (Ingo, W., Krauss, N. 2008). Most MFIs are strongly related with a social mission. For example, the most common “raison d’être” for MFIs is to broaden access to financial services, reduce poverty, empower women, build community solidarity, or promote economic development and regeneration.

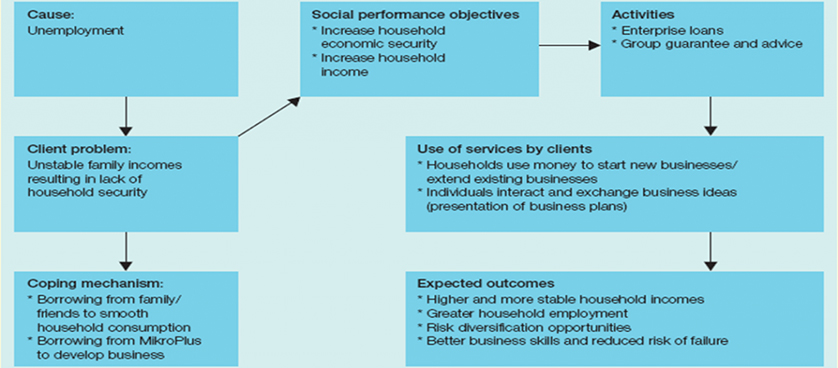

MFIs social performance refers to the extent of their success in meeting these goals, representing more the impact rather than an outcome (IFAD 2006).

As social organizations, MFIs apply commercial principles for achieving social impact. MFIs performance focuses both on social impact and financial outcomes. The social impact is achieved through the way financial services improve the lives of poor and excluded clients, by widening the range of opportunities for communities.

Financial outcomes are achieved through strategic management and focus on assuring organizational performance. The KPIs used to measure performance of microfinance institutions are usually structured in core areas, (Rosenberg 2006) such as:

- Outreach—what number of clients are being served?

- Client poverty level—how poor are the clients?

- Financial sustainability—how profitable is the MFI, in order to maintain and expand its services, without having continued injections of subsidized donor funds?

- Collection performance—is the MFI collecting its loans as planned and expected?

- Efficiency—is the MFI controlling its administrative costs at an optimal level?

A standard international KPI monitored in MFIs is Portfolio at Risk (PAR). It measures the loan portfolio with at least one day missed payment to total loan outstanding at a given time. It refers to the outstanding balance of all the loans that have an amount overdue.

For further examples of MFIs performance indicators, explore the Banking, Mortgages and Credit KPIs examples and the section of smartkpis.com (smartKPIs.com 2010).

References:

- IFAD 2006: Assessing and managing social performance in microfinance, Rome

- Ingo, W., Krauss, N. 2008: Can Microfinance Reduce Portfolio Volatility?, Working Paper Series, USA: New York University

- Rosenberg, R. 2006: Review of UNDP Microfinance Portfolio, The Consultative Group to Assist the Poor (CGAP), Washington D.C.

- smartKPIs.com 2010, Banking, Mortgages and Credit KPIs examples, viewed 27 May 2010

- Impact pathways (IFAD 2006)

Tags: Finance performance, Microfinance, Social Performance