Protecting against financial fraud with KRIs

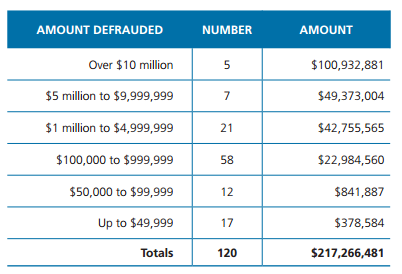

A recent Australia-wide research study on fraud cases within financial institutions, conducted by the governance firm Warfield & Associates, has revealed that businesses and clients have lost over $200 million since 2000 due to employee committed fraud. During this period, 120 cases of fraud directly committed by employees resulted in 123 criminal convictions in Australian Courts.

Some of the report’s key findings include:

- More than 30 of the convicted employees involved in fraud had been with their company for at least 10 years before committing the crime;

- More than 5 had prior criminal records for “deception related offences”; in one of the cases, a perpetrator even had three prior convictions for gambling frauds with no background check conducted;

- Gambling dependence was the main driving influence in over 60 of the cases;

- One in six of the fraud cases took longer than five years to be revealed;

- Creating false loans or stealing from client bank accounts were the most common ways of financial embezzlement.

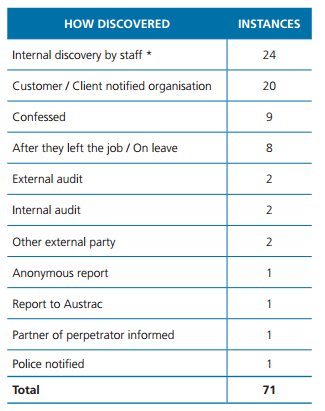

The findings of the report underline major flaws in the current standards and procedures of financial institutions. Background checks and fraud awareness training courses are a clear necessity accompanied by stricter and timely conducted audits within the organization.

Another report, the 2012 Fraud Survey included in the New South Wales Auditor-General’s Report to Parliament emphasizes the findings of the Warfield report, highlighting that 48% of public agencies identified at least one fraud case in the last three years.

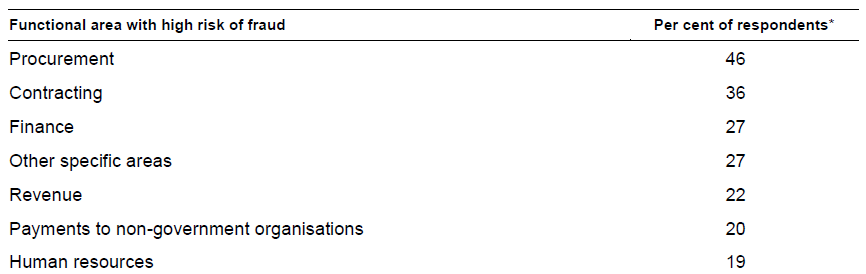

The Auditor-General’s main concerns expressed in the report are:

- More than two out of five agencies do not require staff to take at least two weeks continuous leave each year;

- There is a growing trend in frauds identified in outsourced functions and contracted non-government organizations;

- One in ten agencies do not routinely conduct pre-employment checks of criminal records, work histories and qualifications.

Based on the main issues featured in the two reports, it is clear that the risk of fraud has to be adequately and actively monitored by financial institutions. It is recommended that the following Key Risk Indicators are deployed and monitored:

- % Employees taking two weeks of continuous leave per year: Employees that do not take regular 2 week breaks may be a good indicator of fraud. A high percentage of employees that are involved in illegal dealings are unlikely to hand their work to a colleague for a longer period of time because they risk being exposed. As a result, monitoring this KRI is recommended, and actually a requirement in some companies.

- % Pre-employment background checks: This indicator is recommend to be monitored in order to ensure that the company properly manages the risk of hiring personnel that have criminal records or recorded fraud histories. The background check should focus on criminal records, adequate qualifications and job experience.

- # Fraud awareness training hours per employee: Providing instruction and education regarding fraud for employees is critical to ensuring fraud detection or prevention, as well as nurturing an ethically centered environment within the company.

References:

- Warfield, B. (2013), Employee fraud in Australian financial institutions, Warfield & Associates

- NSW Auditor-General (2012), 2012 Fraud Survey, NSW Auditor-General’s Report to Parliament

- Corporate Risk & Insurance (2013), Fraud research exposes major governance weaknesses

- Fraud Blogsize

- Warfield, B. (2013), Employee fraud in Australian financial institutions, Warfield & Associates

- Audit Office of New South Wales

Tags: Government performance, KRI, Performance in Australia