Measuring marketing performance: market metrics

When assessing the overall firm performance within the market it operates in, measurementfocuses on macro metrics, that capture data regarding the overall market, respectively firmposition within this market.

These metrics help understanding market trends and dynamics, both those of the firm, and those of competition. We will not focus on brand elements in this context, as we intend to deal with them in afuture post dedicated integrally to these.

The most common Key Performance Indicators used in employing performance measurement initiatives at a market level are the following:

1. % Served market refers to the portion of the total market in which the firm operates. From the overall market for a particular product, a firm might might not serve some geographic regions, for example. Therefore, its served market excludes these regions from the total potential market. This is important to assess when desiring to calculate market share; to be relevant, the share will refer only to the portion of the market that is served.

2. % Market share measures the part of a market accounted for by a particular business/entity.

In can be measured either in units sold – % Unit market share, or in sales revenue – % Revenue market share. These two metrics differ in that the first one reflects sales in terms of volume, whereas the second one reflects sales in terms of revenue being influenced, therefore, also by the prices at which products are being sold.

3. ÷ Relative market share measures the firm’s market share relative to the share of the market leader. This metric helps in benchmarking firm position against that of the industry leader.

4. # Market share rank measures the position of the firms in its market by arranging market shares of all players on the market in descending order, on the 1st position being that of the firm with the largest share.

5. % Market concentration measures the portion of the market accounted for by a small number of firms (usually, the largest two or three). This is important to calculate as it can indicate the degree at which a small number of firms can influence market parameters (prices, imposing industry norms etc.).

6. % Market growth measures the increase in demand for a product, by comparing demand from one period to demand from the period before.

Along with % Market share, the % Market growth is used in constructing the BCG (Boston Consulting Group) matrix used for making decisions regarding product strategy.

All these performance indicators should be measured and monitored when assessing market trends and dynamics. It is important to clearly define the relevant market from the overall market, to measure how much of this market is accounted for by the business, how great is this share by comparison to competitor shares, especially that of the largest competitor. Also important is the awareness of the market composition, this indicating the degree of free competitiveness. Finally decisions should be made based on market growth predictions.An important thing that ought to be carefully dealt with when measuring market dimensions is providing a clear definition of the market; this should be not too narrow and not too broad. Managers should define the market by focusing on a specific list of clear parameters: products, competitors, geographic areas and time intervals.

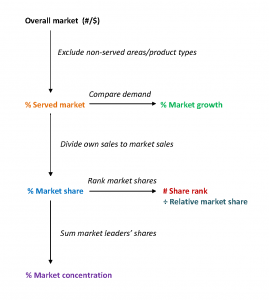

We have inserted below a figure of how these market KPIs relate to each other in the way they are constructed and cover various market dimensions:

Image Source:

Tags: KPI in Practice, Marketing performance, Performance Measurement