Investment bankers views on the 2010 World Cup South Africa – England likely to win the World Cup

In a previous blog post we presented the Goldman Sachs Investment Research Division report on “The World Cup and Economics 2010”. Besides forecasting football scores and rankings, the report also presents some interesting correlations between the FIFA world rankings and two economic indicators: Gross National Product (GNP) per capita and Growth Environment Scores (GES).

In today’s post we present a second report on World Cup 2010, currently released by J.P. Morgan Europe Equity Research Division.

The J.P. Morgan report “A Quantitative Guide to the 2010 World Cup” predicts that according to the forecasting algorithm used, England is likely to win the 2010 World Cup edition.

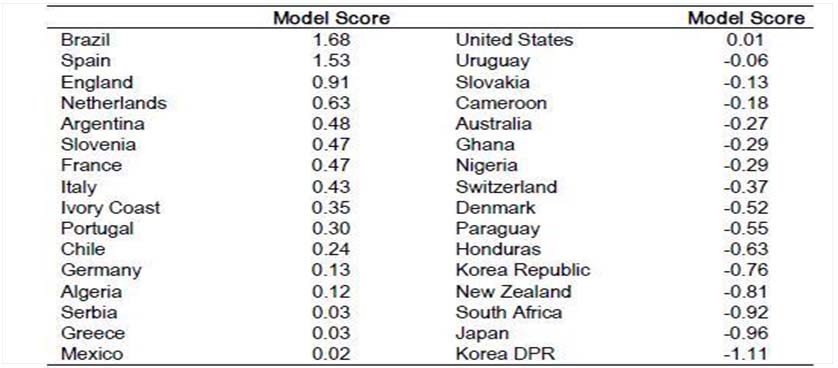

Although the initial World Cup Model Score shows Brazil as the strongest team taking part at the tournament, further correlations with the fixture table give England as the World Cup winners, followed on the 2nd place by Spain and on the 3rd place by Netherlands.

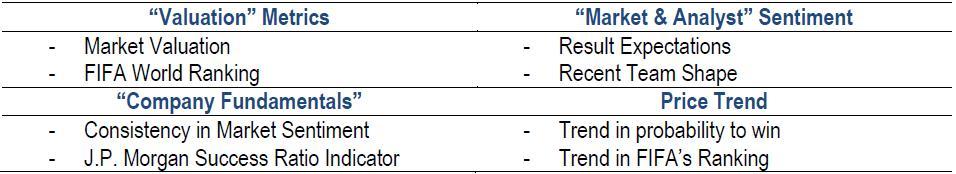

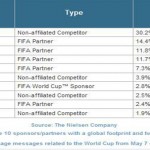

The forecasting algorithm used is based, according with the JP Morgan experts, on a successful Quant Model developed by J.P. Morgan over the years, which combines in its current adapted methodology: market prices, FIFA rankings, historical results and the J.P. Morgan team strength indicators. All these metrics, but also many others that were not mentioned above, are grouped in what is called the J.P. Morgan Cazenove Quant World Cup-Picking Model presented below.

Three of the most interesting and flavored metrics used in this model are:

• Consistency in Market Sentiment: Average (Probability of Winning) / (Max (Probability of Winning) – Min (Probability of Winning))

In terms of this metric, Brazil, England and Ivory Coast provide less risk in terms of the results surprise.

• J.P. Morgan Cazenove Success Ratio Indicator: it is calculated by computing the Win Ratio (Proportion of wins from the total number of games played) and scaling it by FIFA World Ranking

In terms of this metric, Netherlands, Spain, Chile and Brazil should be preferred, when picking a winner for the World Cup 2010.

As the model in its current structure takes in consideration only fixture results from the normal playing time interval, a new metric was decided to be introduced in order to cover the probability of a drawn match in the knockout phases.

• Penalty shootout metric: combines ability to score with goalkeeper ability using the formula shown below.

In terms of this metric, England, Spain, Netherlands and Germany are the favorites to win the World Cup.

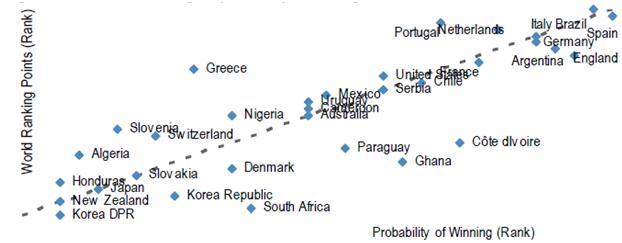

Other noticeable facts that are outlined by the report are the World ranking vs probability of winning correlations which show that there are a few disagreements between FIFA World Ranking and the low probability of winning, in the cases of Portugal, Netherlands, Greece or high probability of winning, in the cases of England, Argentina and Ivory Coast.

Additionally to these findings, a final aspect that the J.P. Morgan report indicates is that the 3 favorite teams, as outlined by the World Cup Model Score: Brazil, Spain and England represent a 52, 5% probability of winning the World Cup.

However, despite all these predictions, football fans should still keep up in mind at all times that the “ball is round” and that football is by its nature an unpredictable game. No later than last night, Spain, the European Reigning Champions were defeated with 1-0 by their Swiss opponents, which started as outsiders, in a game from the first round of the group stage at the South Africa World Cup 2010.

References:

- J.P. Morgan 2010, A Quantitative Guide to the World Cup

- smartkpis.com blog 2010, Investment bankers views on the 2010 World Cup South Africa – The World Cup and Economics 2010

Image Source:

- J.P. Morgan 2010 – A quantitative report to winning the World Cup 2010

Tags: Football performance, JP Morgan, KPI in Practice, Performance in South Africa, Performance Measurement, Sports performance, The Quant Model, World Cup 2010