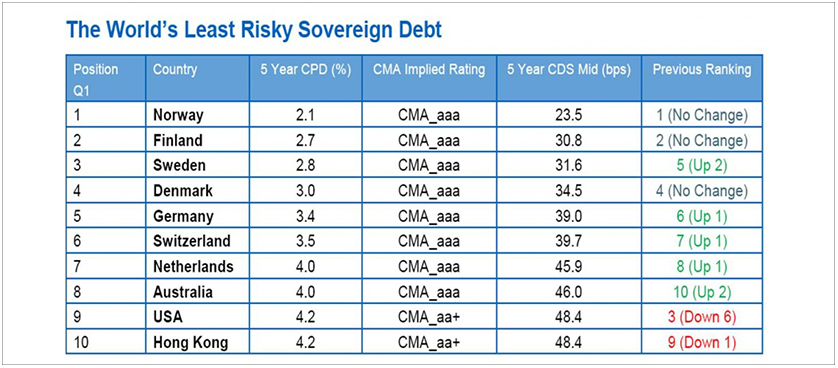

Global ranking of countries based on sovereign debt risk

The most recent report of global sovereign credit risk for the 3rd Quarter of 2010 presents the country rating based on the Cumulative Probability of Default (CPD), indicating the probability of a country being unable to honour its debt obligations over a given time period. CPD is calculated using an industry standard model and proprietary credit data from CMA Datavision TM. Reference to ‘risky’ is purely in terms of the probability of default derived from the price of the CDS (CMA, 2010).

Of the countries in the top 10, USA lost six positions, as the world’s largest economy fluctuates between growth and no growth scenarios, fueling the ‘double dip debate’. On the other hand, Australia had the best improvement of the countries in the top 10, in a quarter which has seen a new coalition government staying in power.

The report focuses on changes in the risk profile of sovereign debt issuers, with the intention to identify trends and drivers of change. The world debt risk is divided into eight regions: US & UK, Western Europe, Emerging Europe, Scandinavia, Latin & South America, Middle East & Africa, Australasia and Asia. In addition to identifying themes within these regions, the macro trends across the sovereign debt sector are also discussed.

References:

Image Source:

- CMA (2010)

Tags: Governance, Report Analysis