Executive compensation and performance

The compensation of the top executives represents an important aspect of administrative science, as it links together aspects that relate to corporate governance, human capital, organizational culture and performance management. Ideally, the executive remuneration philosophy of the organization should ensure that the remuneration properly reflects the duties and responsibilities of its executives and that remuneration is competitive in attracting, motivating and retaining people of the highest caliber.

Top executives are increasingly negotiating formal contracts that typically last 3-5 years and that specify minimum base salaries, target bonus payments, severance arrangements.

Most senior executive pay packages contain four basic elements:

- Base Salary

- Annual Bonus

- Share Options

- Long Term Incentive Plans

Additional components of pay can include:

- Restricted Stock

- Retirement Plans

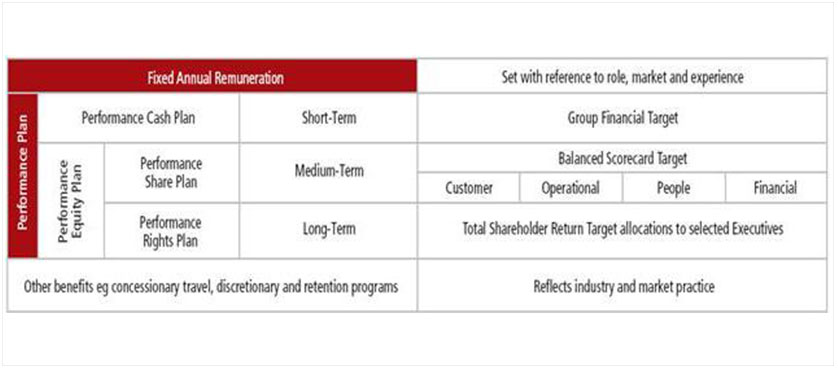

An example of such a reward program mix is illustrated below. It contains elements specific to the industry in which the organisation operates, in this case aviation (Qantas Group, 2007):

- Fixed Annual Remuneration (FAR)

- The Performance Plan, comprising:

- the Performance Cash Plan (PCP) – a short term cash incentive; and

- the Performance Equity Plan – made up of a medium-term incentive, the Performance Share Pln (PSP) and a long-term incentive, the Performance Rights Plan (PRP);

- Concesionary Travel Entitlements, some targeted retention arrangements and other discretionary benefits considered appropriate from time to time.

Another important issue is the retention aspect and the fact that executives have more job options than other employees. They also tend to have relatively high levels of confidence in their abilities and may be more willing to leave the organization (Bacal, 2004). The importance of motivating executives through a proper reward system in place is essential in this context.

However, common perceptions regarding executive compensation can also be surprising. In an interview with Forbes magazine (Forbes, 2010), compensation expert Robin A. Ferracone identified two characteristics of executive compensation in the 1500 S&P companies reviewed:

- only 5% of S&P 1500 executives receive on a performance adjusted basis of over $25-100 million per year. These are considered the extremes that attract a lot of media attention.

- only about 8% of the differences in pay are driven by performance. The size of the company and industry are bigger influencers of the CEO compensation package compared to the influence performance has.

Additional resources:

- The 2009 report of the Conference Board Task Force on Executive Compensation.

- The smartKPIs.com library of remuneration and compensation KPIs examples.

- Forbes Magazine, 2010, Myths About Executive Compensation, an interview with Robin A. Ferracone

- Robert Bacal, 2004, Manager’s Guide to Performance Review, McGraw – Hill Companies, Inc.

- Qantas Group, 2007, Qantas Annual Report – Director’s Report for the year ended 30 June 2007, page 59

- Qantas Group, 2007

Tags: Human Resources performance, Performance Pay, Qantas, Talent management