Economic value added or EVA ®

Economic value added or EVA® is a measure of the true economic profit of a company. Although in a sense it is nothing more than the traditional, commonsense idea of “profit”, it makes a clear separation from dubious accounting adjustments that may occur (remember ENRON, which for a long period of time was reporting profits, while in fact was in the final approach to becoming insolvent).

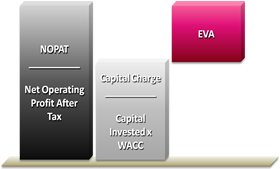

EVA® is calculated as the difference between the Net Operating Profit After Tax and the opportunity cost of invested Capital. This opportunity cost is determined by the weighted average cost of Debt and Equity Capital (“WACC”) and the amount of Capital employed.

The term EVA® is a registered trademark by its developer, the consulting firm Stem Stewart & Company, since 1994. Still, another much older term for economic value added, the Residual Cash Flow, has been also used by companies for years. These measures have their foundation in the residual income and internal rate of return, concepts developed in the 1950s and 1960s. Residual income was originally developed and used by General Electric (GE) to measure performance, and was popularized by McKinsey & Company as economic profit (Carton, Hofer, 2006).

Unlike other measures, EVA® can be calculated at divisional level (i.e. Strategic Business Units), can be used for performance evaluation over time, as it is a flow, and it captures the period-by-period value creation or destruction of a given firm or investment and thus makes it easy to audit performance against management projections.

Unlike other measures, EVA® can be calculated at divisional level (i.e. Strategic Business Units), can be used for performance evaluation over time, as it is a flow, and it captures the period-by-period value creation or destruction of a given firm or investment and thus makes it easy to audit performance against management projections.

EVA® can also be used for corporate valuation and equity analysis, motivating the managers and setting organizational goals.

Even though it is a much appreciated indicator, it also has some limitations. EVA® overemphasizes the need to generate immediate results and therefore it doesn’t stimulate investments in innovative products or process technologies. Also, when calculated at the divisional level of a company, it does not control for size differences, and a larger plant or division will tend to have a higher value than its smaller counterparts.

Taking into consideration the usefulness of EVA® , many companies have adopted it as part of a comprehensive management and incentive system, which leads their decision processes.

References:

- Eva Company

- Hock, C. (1999), Economic value added (EVA): its uses and limitations, SAM Advanced Management Journal

- Carton, R., Hofer, C. (2006), Measuring Organizational Performance: Metrics for Entrepreneurship And Strategic Management Research

Tags: Finance performance, Performance Measurement