Economic forecasting – not an exact science. The Bank of England Forecast

An economic forecast refers to making prediction about the economy and identifying increasing, stagnant or declining trends. Economic forecasts are provided by international organizations like the International Monetary Fund (IMF) or the World Bank, but also by national governments and financial institutions. Forecasting is based on series of KPIs like $ Gross Domestic Product (GDP), % Inflation, % Unemployment or $ Fiscal deficit.

Economic forecasting influences on one hand the governments monetary policy and on the other hand the level of investment from international organizations in the public and private sector.As economic forecasting is no exact science, understanding and assessing its uncertainty becomes essential. An example of organization which overlooked the field’s unpredictability is the Bank of England.

In the final quarter of 2013, The Bank of England has predicted an increase in GDP, and also the chances of reaching a 7% unemployment rate by 2016 at 10%. Based on this predictions, in order to support UKs economy, The Bank of England declared maintaining the interest rate as it is until unemployment reached 7%.

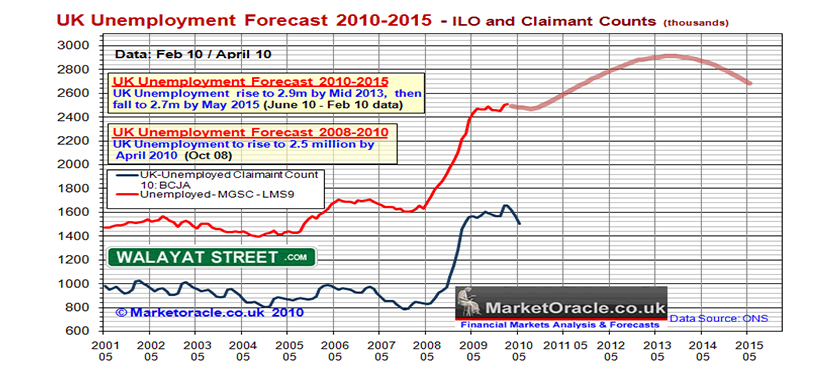

Unemployment rates in the UK are measured using two methods: the Claimant count method and the International Labour Organization (ILO) Labour Force Survey. The Claimant count method revolves around the beneficiaries of Job Seekers Allowance (JSA). The second one is compiled by using the ILO criteria, which compares unemployment differences between those who are actively looking for a job and those who already have a job and it is due to start in the next couple of weeks.

Three months after the initial forecast, the first quarter of 2014, when the chances of reaching 7% in the unemployment rate skyrocketed at 70%, The Bank of England shifted its forward guidance philosophy. A more complex analysis of the labor force in UK was presented, based on this new model they created a new formula for calculating the interest rate. This new model focuses on stagnant wages and low productivity of people. By doing so, they will benefit from both situations, no matter the outcome of unemployment rate in 2016.

Engaging in new types of forecast puts the bank in a difficult position, as a poor forecasting rate reflects poorly on its image and economy itself. As a result, some companies might will lose faith and hold their investments, or the government itself could rethink the monetary policy.

The actions taken by The Bank of England in an attempt to keep up with the sudden changes reflects the unpredictability of economy, as well as the uncertainty of economic forecasting.

Economic forecasting is based on assumptions. Every forecaster predicts an economic development over a period of time based on the assumption that economic policies will not change in that period. This is a very confident assumption giving the fact that economic policies can change overnight due to unforeseen national and international events like: drops in foreign currency, law suits between corporate giants, wars, drops/ increases in oil prices, catastrophic natural events that can unbalance the economy of an entire region. These are the major factors that make economic forecasting such an uncertain science.

References:

- Karaian J. (2014), The Bank of England has confirmed that economic forecasting is basically impossible

- Pettinger, T. R. (2014), Measuring Unemployment in the UK

- Laureant, T. and Kozluk, T. (2012), Measuring GDP forecast uncertainty using quantile regressions

- Bank of England (n.d.), Monetary Policy Themes: Forecasting output and inflation

- The Independent (2013), Bank of England upgrades growth forecast for UK economy as Mark Carney hints at rise in interest rates

Image source:

Tags: Economic performance, Government, Performance in UK, The Bank of England, Unemployment Rate Forecast