Creating Modern Governmental Agencies – Best Practices from the USA

“We can’t ignore facts. We can’t ignore data.” – Barack Obama, former President of the United States

Get the opportunity to grow your influence by giving your products or services prime exposure with Performance Magazine.

If you are interested in advertising with Performance Magazine, leave your address below.

“We can’t ignore facts. We can’t ignore data.” – Barack Obama, former President of the United States

Measures the probability for a company to be unable to recover all its expenses incurred, from the revenues obtained.

Image Source: Freepik

In most cases, in small businesses within the service sector, the lack of managerial education of entrepreneurs negatively impacts the quality of the entire managerial process.

This is one of the reasons for employing modern methods of management in small companies from the third sector, in order to obtain qualitative management, even though in some specialty researches, these methods are recommended only for managers of large enterprises or businesses.

There are five types of modern methods of management:

As the name suggests, it is a management approach that systematically integrates key management activities that are geared towards achieving efficiency and effectiveness of the goals set by the organization.

In a small company, it is easier to familiarize employees with the company’s objectives, responsibilities can be established together with employees whose role in achieving them increases.

Implementing this method involves several steps, as mentioned by professors Hinescu Arcadie and Jinga Cristina:

This management style is focused mainly on the obtained results, attendance, behavior and motivation of employees. Some authors do not make any clear distinctions between the method of management by objectives and management by results, considering them as simply different ways of implementing the same method.

This method is based on achieving a set of key outcomes, especially certain values of financial KPIs (such as $ Net cash flow, # Breakeven point (BEP)). Subordinates have a lesser role in this form of management. Targets are often set at management level and then imposed or negotiated with those responsible for obtaining those results.

The reward system is more rigorous than the management by objectives system, due to outstanding rewards and radical sanctions and attempts to create competition among employees to achieve the objectives.

Such a method requires the establishment, within the organization, of an autonomous structure in order to facilitate the solving of a complex problem and to remove certain deficiencies of coordination.

This method requires a project manager, a graph of activities set-up in a Gantt chart with the order of the activities, their duration and required resources. The coordination of the project requires managerial knowledge on one hand, and field specialty-related know-how on the other. Those who are part of the project should not lack qualities such as creativity and innovation power.

During the project development phase, similarities may occur between how the company is organized and how the team is organized, but it is not necessarily a condition to be fulfilled. The project team can be multidisciplinary but the project leader will have a special responsibility and increased authority in order to carry out its tasks and team.

It is a modern method of management, applied especially within companies already on the market for a longer period of time, more mature, situated in a period of consolidation and business development.

It assumes the fact that the manager has implemented a functional leading and tasks coordinating system and, thus, he only intervenes in decisions of major importance, or when certain specific situations are considered exceptions to the classic way of doing business.

The method is built upon the use of information taken from the company’s previous work and current and future trends, as a strategy to anticipate critical moments and to exploit favorable situations that may occur.

Management by exception has some specific features, as Samuel Certo and Trevis Certo explain in “Modern Management: Concepts and Skills:”

Unfortunately, in the case of an authoritarian management, this method does not work, because subordinates will manifest a reluctance to communicate to their superiors the abnormal situations they face.

This is a planning method that involves setting the costs of each objective of the company and trying to meet their established level. The main tool used for this modern method of management is the budget – hence the name of the method.

The method involves the participation of all the staff in achieving the objectives, flexibility of the structure and administration of the income and expenditure system, together with realistic goals setting.

The method is not usually applied alone as it is often combined with other methods of management (management by objectives, by results, or by projects).

If, in small businesses the implementation of these modern methods is limited, within larger organizations, broader mediums are created for their use, due to the existence of a larger collective that can be shaped into more complex hierarchical structures.

Both in developed countries with a functioning market economy, as well as those which are in transition, there is a tendency among entrepreneurs to focus on taking advantage of their opportunities and only to a lesser extent on risk assessment or analysis of potential adverse consequences resulted from their decisions.

In small businesses there is a need to focus their limited resources on concrete and achievable objectives, in those areas where the company’s competitive advantages ensures its best chances of success.

We are proud to announce that between the 20th–22nd of March 2019, Alina Miertoiu, Senior Consultant for The KPI Institute, hosted the first Certified OKR Professional 3-day training course in Kuala Lumpur.

Whether a business is considered a success or not is largely determined by its financial performance which is measured via a number of financial KPIs.

So knowing that, how can we detect which are the truly “Key” indicators, i.e. those Critical Factors or Key Value Drivers that, if they change (for whatever reasons) they produce a chain reaction that leads to a material change in earnings, returns and ultimately the value of the company.

Let me suggest the two ways in which you should look at KPIs, and if you’re still confused, you can look at how Visa measures its key value drivers.

What are the EBITDA margins, operating profit (or EBIT) margin or net profit margin and the top line growth? Cash Conversion Cycle, Working Capital ratio, Current Ratio, etc. As long as the benchmarks are met, management is usually content; this is mostly looking at historical data aka in the “review mirror”.

Which potential triggers, aka KPIs or Key Value Drivers – if they change, could make an impact on the stock price?

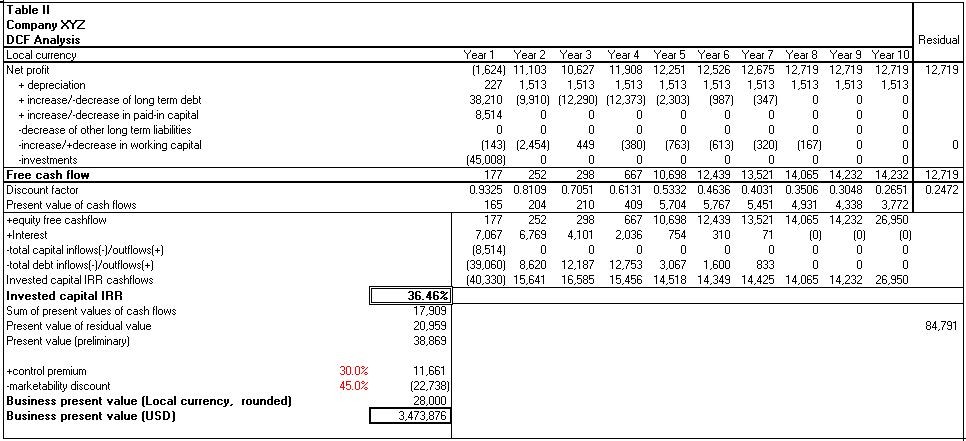

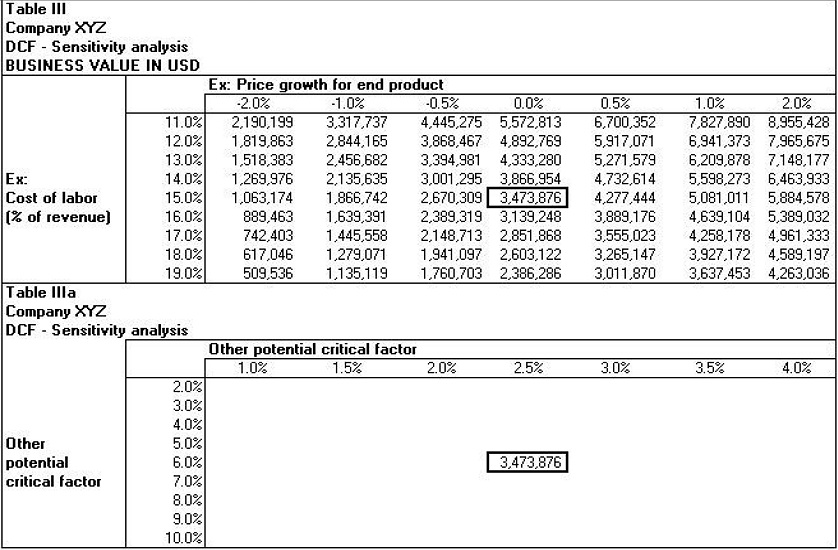

If we look at Table III – through scenarios and sensitivity analysis, one can detect those key factors that are critical to the overall value of the company, i.e. if they change, they produce a material effect on the value.

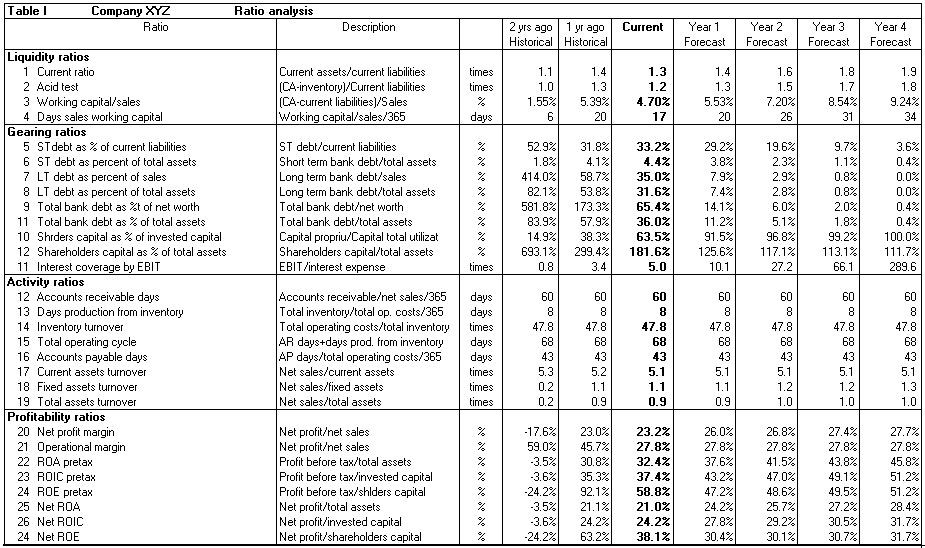

In Table I, besides the data shown in historical, we can see the current and forecast form. As when driving a car, one does not look in the review mirror but seldom, similarly when analyzing data and trends, one looks in the past to better grasp the capability of the company and be able to forecast. As the road ahead is never as the one behind, other parameters have to be considered for a more accurate forecast.

In financial terminology, Business Intelligence (BI) is using and looking at historical data while Business Analytics (BA) is looking forward. BI is important to improve one’s understanding of business based on past results, while BA tools assist one better understand what might be going to happen.

Through trial and error, using sensitivity analysis (as shown in Table III), one detects the critical factors/key value drivers for a company. Table IIIa, or even IIIb, IIIc and so forth, is shown empty since it could be filled with data that results from the variation of any two other parameters.

Identifying materiality is often a complicated and time-consuming process, but it is imperative for an analyst to narrow down the list of factors to those that may be critical and which are worth monitoring. I suggest that materiality can be identified by common sense and quantified by performing various scenarios and sensitivity analyses.

The analyst should develop an accurate financial model, with a correct interrelation of the elements in worksheets, i.e. inputs, balance sheet items, income statement components, depreciation and investment, debt, working capital assumptions and cash flow. Only by having implemented a reliable financial model can one correctly capture when a slight variation in KPIs produces an impact on company value.

Image sources: