Banking disclosed: issues of low transaction volume branches

Over the past decades, financial institutions worldwide or banks, in particular, have had to deal with the pressures of an industry that is continuously changing its game. New, or updated, market regulations, increasing defaults on loans due to unemployment, collapses in the housing market, and rising overhead costs, have all exhausted the banking system. Moreover, the fragmentation between large transaction volume branches and low transaction volume branches has substantially impacted numerous banks all over the world.

Low transaction volume branches are the result of a sizeable decrease in teller transaction volumes. Due to their negative impact on bottom lines, low volume branches have become a matter of real concern for numerous bank networks. The high labor costs associated with low volume branches no longer justifies the cost per transaction, which stands to be the highest in any bank’s network of branches.

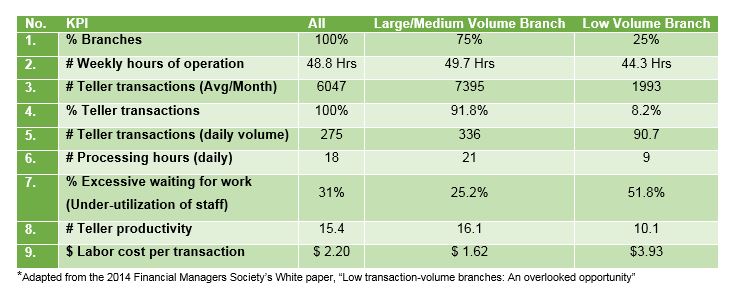

In short, low volume branches distress the performance of the entire bank network by negatively impacting non-interest expenses. In their white paper entitled “Low transaction-volume branches: An overlooked opportunity”, the Financial Managers Society reveal a comparative analysis between low and large / medium volume branches based on the most relevant productivity key performance indicators:

The performance outlook of low volume branches, as revealed by the hereby presented key performance indicators, can be summarized as follows:

- Low volume branches account for less than a quarter of the total network banking operations;

- # Teller transaction/% Teller transactions is an unquestionable measure of branch productivity;

- Transaction volumes are significantly lower with low volume braches;

- Teller transactions account for only 6.5% of the low volume branch transactions;

- Weekly hours of operation are too long for the volume of work, leading to a 51.8% under-utilization of staff;

- Teller productivity is 40% lower in low transaction volume branches, as opposed to large/medium volume branches;

- Low volume branch labor costs are 143% higher than those for large/medium volume branches.

It is rather easy to blame the economic grounds for this situation. However, technology is just as accountable for this misfortune. In its desire to maintain % Customer satisfaction levels, no bank has ever stepped aside from attending to the latest trends in banking technology. Internet banking, deposit and withdrawal automated teller machines, video ATMs, mobile remote payment systems, teller cash recycling, are all putting constant pressure on both branches and bank personnel. Many of the banking products and services are now automated, which makes banking, as a profession, rather obsolete. The fact of the matter is that younger generations (X, Y, and the Millennials) have even come to regard customer service as redundant. Low transaction volume branches may not be a shortcoming in today’s banking networks. They might just be the off-spring of self-directed technologies.

It is a well-known fact that technology decreases teller transactions. Less teller transactions lead to labor cost savings, which, in turn, are part of an important cost management strategy. But, even though workforce optimization is a new trend across all industries nowadays, teller transactions have been the backbone of a global banking systems for centuries. So, what is the prognosis for teller systems worldwide? Are low transaction volume branches becoming the predecessors of mass bank teller layoffs? Are performance management systems the actual drivers for technological reign?

The perspectives may seem grim, but there just might be a logic behind all this. Low transaction branches are a result of many things, such as: branch location, community affiliation with banking operations, sales force productivity, teller service timeliness and accuracy, customers’ awareness of the bank’s products and services, dual control by the use of technology etc. Low transactions lead to reduced teller transactions for the same working hours and labor cost. This leads to the under-utilization of staff. Under-utilization of staff is costly in terms of productivity and operational performance. It comes to the point where other branches in the network are paying the salaries of low volume branches’ personnel. From a performance management point of view, an under-performing branch must either improve its performance, or close altogether. So what can bank networks do with their low volume branches?

Having that teller transactions account for over 90% of large and medium volume branches operations, a possible action to consider would be the absorption of under-performing low transaction volume units into other branches that are performing according to, or exceeding expectations. Balancing staff with transactional flow by redirecting surplus teller staff to well-performing branches might be another option. Some other recourses to low productive branches can account for:

- The implementation of a performance management system that optimizes low volume branch performance;

- The use of performance management tools to measure and monitor individual performance;

- An initiatives portfolio for performance improvement;

- The professional conversion of tellers to sales consultants who are subsequently evaluated on their contribution to the increase of the customer base;

- Activating dormant client portfolios in low volume branches through central unit telesales;

- Transforming teller idle time into productive time by assigning inoperative tellers the task of contacting clients in the portfolio for new bank products and services;

- Re-modelling the entire structure of under-performing low volume branches by turning them into completely automated teller stations.

If not handled, the issue of low volume branches will continue to inhibit both bank networks and bank personnel. Having that technology is a must as teller transactions will continue to decline in favor of fully automated teller machine. The volume in teller transactions will also continue to decrease due to external economic shifts and hazy consumer behavior. Measuring the loss of low transaction volume branches as a cost of doing business is no more than a compromise. Taking action to correct the loss of low volume braches identifies the weakness and turns it into a strength.

References:

- Cheng, E. (2014), Trends in Retail Cash Automation: A market Overview of retail Cash Handling Technologies

- Financial Managers Society (2014), Low-transaction volume branches: An overlooked opportunity

- Financial Managers Society (2012), Low-transaction volume branches: An overlooked opportunity

Image source:

Tags: Banking performance, Finance performance, Strategic Performance Management