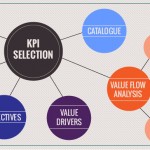

A taxonomy of sources used for KPI selection

smartKPIs.com Performance Architect update 36/2010

Working with Key Performance Indicators (KPIs) requires selecting a group of relevant KPIs first. There are many options for this: start with a blank page, review other sources, or get someone else (such as a consultant) to do this for you among others.

Some of the general rules to follow on embarking on such a journey are:

- Do your research. Selecting KPIs is a learning experience, a journey in itself. There are many insights to gain by taking it step by step instead of just getting to the destination. Research is an important component of this journey.

- Acknowledge the uniqueness of your environmental settings. While some KPIs are widely used across organisations (i.e. % Satisfied customers, $ Sales revenue and % Profit rate), others are unique to each organisations as they reflect their strategy and specific conditions of operating. Each organisation should select the KPIs based on their relevance and not on their popularity.

- Clarify what you want to achieve. If you want to improve things and learn from KPIs, you should not avoid selecting challenging KPIs, difficult to measure or difficult to improve. The easy choice is selecting KPIs that make you look good. While this may serve some purpose on the short term, on the medium to long term it will impact the relevance and credibility of KPIs in the organisation.

Having these general rules in mind, the question is: “Where do we do our research to inform the KPI selection process?”. The main sources of information can be grouped in three categories:

Primary Sources

- Front-line employees input – they are at the core of the value generation chain and know what matters for operational success.

- Input from managers – due to their perspective across the value generation process, role in shaping strategy and their relationship with various stakeholders.

- Board input – in many instances they mandate the use of specific KPIs and their selection in strategic / operational is non-negotiable.

- Input from suppliers – their insight in the supply chain is valuable as they can bring an external perspective to what needs to be measured and improved

- Customer input – their opinion matters.

Secondary sources

- Strategic development plan (3-5 years)

- Annual business/strategic plan

- Annual reports

- Internal operational reports

- Competitor review reports

External sources

- Printed catalogues (books such as: Performance Prism)

- Online catalogue (www.smartKPIs.com)

- Annual reports of other organisations (a good repository is KPIs in Practice)

- Expert advice (recommended lists such as the one in Performance Architect Update 35)

- Questions in discussion forums (such as LinkedIn or Answers)

Individually or in combined, these sources can generate a list of prospective candidates for KPI selection, anchored to organisational objectives. Ultimately the decision on which KPIs will be used should be based on discussions within the organisation to determine the most relevant ones. Consultants can be useful in this process as facilitators, but not necessarily as “fountains of truth”. Their role should be more as guides on this journey, providing tools, information and advice, but not developing the final list of selected KPIs in an ivory tower. Enjoy the journey!

Stay smart! Enjoy smartKPIs.com!

Aurel Brudan Performance Architect, www.smartKPIs.com

Image source:

Walker, Rob 1992, “Rank Xerox – Management Revolution”, Long Range Planning, Vol. 25, No. 1, pp. 9 to 21

Tags: KPI, KPI Selection, Performance Architect Update, Performance Measurement