How To Use a Balanced Scorecard in a Board’s Performance Evaluation

Image source: Werner Pfennig | Pexels

Throughout the years, many studies have examined the use of the balanced scorecard (BSC) in a board’s performance evaluation. Why is this important and how can this be implemented?

The modern business landscape is characterized by fast-changing trends, an expanding weight from the competition, and risks emerging from new trends. This is why a good corporate governance system is what can help companies achieve high business performance despite uncertainties. Having a control mechanism will help managers carry out business activities that can maximize profits for shareholders. Board members represent an important internal control mechanism.

The BSC, designed by Robert Kaplan and David Norton, is primarily made of financial and non-financial benchmarks. The BSC model starts from a defined mission, vision, goals, and strategy of the company and identifies specific goals, tasks, benchmarks, and initiatives from four basic causal relationships: financial perspective, stakeholder perspective, internal business process perspective, and learning-growth perspective.

The BSC Component in the Context of a Board’s Performance

In 1996, Kaplan & Norton suggested that the vision and strategy of a company be more specifically defined from four basic, interconnected perspectives:

- Financial Perspective – how to implement a strategy that will maximize profits for equity owners.

- Customer Perspective – how to achieve customer satisfaction and loyalty.

- Internal business process – how to achieve an effective and efficient business process.

- Learning and Growth Perspective – how to gain human capital competitive advantage.

Later, in 2004, Kaplan & Michael E. Nagel proposed a three-part BSC program:

- Enterprise Scorecard – synchronized list of results at company level

- Board Scorecard – synchronized list of Board results

- Executive Scorecard – synchronized list of executors’ scores

Read More >> The Balanced Scorecard Approach: Performance Management at the Departmental Level

Synchronized lists at the company level ensure that top managers, starting from a well-defined company strategy, goals, tasks, benchmarks and initiatives through the four outlined perspectives. This process converts the company’s strategy into operational terms.

It is necessary to build a synchronized list at the board level. That is, the board of directors should evaluate and approve the corporate strategy map and the corporate level’s harmonized list. According to Kaplan and Nagel, a synchronized list at the board level also has four perspectives:

- Financial Perspective – Similar to the company level, the goal is to maximize value for equity owners.

- Stakeholder perspective – This is a broader perspective than at the company level because it is now important to respect the interests of all stakeholders.

- Perspective on internal business processes – This explains how the board contributes to achieving shareholder goals and relates to performance monitoring, reward systems, etc.

- Learning and Growth Perspective – This captures human capital as a source of competitive advantage, related to the specific skills and the knowledge and capabilities of board members.

Application of the BSC to a Board’s Performance Evaluation

According to research published in the Managerial Auditing Journal, studies that have suggested the possibility of using the BSC in evaluating the board performance recognize the financial dimension, the stakeholders’ dimension, the internal processes dimension, and the learning and growth dimension in the BSC.

The framework of the board’s BSC is based on identifying four basic elements in each dimension: the objectives, the performance drivers, the measures, and the targets:

- The objectives reflect the board responsibilities;

- The performance drivers are actions taken by the board to achieve the objectives. Each performance driver should be linked to specific measures and targets;

- The performance measures are used to control the performance drivers and assess whether the board has achieved the goals;

- The targets reflect the best practices of the industry.

Using the BSC in a board’s performance evaluation can help define strategic contributions of the board; provide a tool to manage the composition and the performance of the board and its committees; clarify the strategic information required by the board, and help monitor the structure and performance of the board and its committees.

The Evaluation Process: Agents and Contents

According to the study “Evaluating Boards and Directors”, evaluating board performance may be done by an internal party represented by the chairman of the board. In some cases, it may be appropriate to delegate the evaluation process to a non-executive member, a lead director, or a committee of the board. Also, the evaluation process may be carried out by an external party who has experience in corporate governance and performance evaluation.

The self-evaluation method is a common way to evaluate board performance. Even though this method is characterized by confidentiality, biases can still occur. The close work relationship between chairman or the non-executive member and the board members can affect the objectivity of their point-of-view. The lack of skills and time in conducting performance evaluation can be a major influence on the evaluation results.

Through a nominating committee or an audit committee, a higher degree of objectivity and independence can be achieved; however, the bias risk will remain.

Hiring an external advisor is applicable for the non-availability of the necessary skills for the evaluation process and achieving greater transparency and objectivity. The external counselor may be a professional advisor. Several enterprises use a trusted adviser as the board prefers to deal with people whom they know and trust, but it is better to use a professional advisor that has a proven technical skill in their past experiences and a high degree of independence.

According to “Board Evaluations: making a fit between the purpose and the system,” there are four basic elements that should be evaluated: responsibilities, operations, structure and membership of the board.

- The responsibilities element aims to evaluate the fulfillment of the board’s responsibilities.

- The operations element aims to assess the board’s relationship with the management.

- The structure element aims to assess the board’s composition.

- The board membership element aims to assess the overall board’s skills and knowledge, experience, competence, ethics, diligence, and independence.

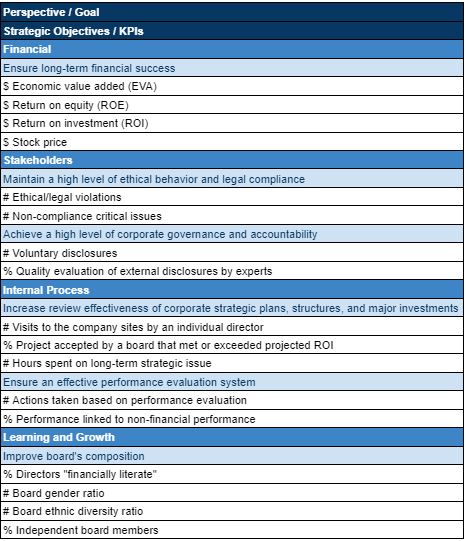

Figure 1. Strategic Objectives and KPIs | Source: The KPI Institute

The BSC is an advanced performance management tool that supports organizations to transform vision and strategy into short-term and long-term targets and specific measuring rules. The application of a balanced scorecard in evaluating a board’s performance has been proven through many studies as an effective performance management tool. It also helps a board’s direction to be more aligned at the company and operational level.

Read More >> SBSC: Blending Sustainability With the Balanced Scorecard

Using a BSC in a board’s performance evaluation requires skillful and independent evaluation agents to maximize its potential. To gain the right skills and learn how to implement a balanced scorecard management system in your organization, sign up for The KPI Institute’s Certified Balanced Scorecard Management System Professional course.

**********

Editor’s Note: This article has been updated as of September 17, 2024.

Tags: Balanced Scorecard, Board Performance, Board Performance Evaluation