TESCO, working to make what matters better, together

How does one of the world’s largest retailers, with over 530,000 employees serving millions of customers a week, manage to keep the pace with the performance?

In any business, clear direction is vital. Tesco’s vision guides the direction and the decisions it takes as an organization. Tesco aims to be the most highly valued business by: the customers it serves, the communities in which it operates, the loyal employees and the shareholders.

Tesco aspires to be:

– Wanted and needed around the world– not only as the shop of choice for customers, but also as the place people want to work, shareholders to invest and communities welcome;

– A growing business, full of opportunities– aiming at offering something new every time;

– Modern, innovative and full of ideas– Tesco’s success is based on trying to understand customers’ needs better than anyone else, and then to innovate, in order to make their lives easier;

– Winners locally whilst applying the skills globally– retail is local because cultures, tastes and regulations are different, but the core skills learned in one place can be applied in others;

– Inspiring, earning trust and loyalty from customers, colleagues and communities– Tesco wants to be a company that earns trust, not just respect, through everything it does.

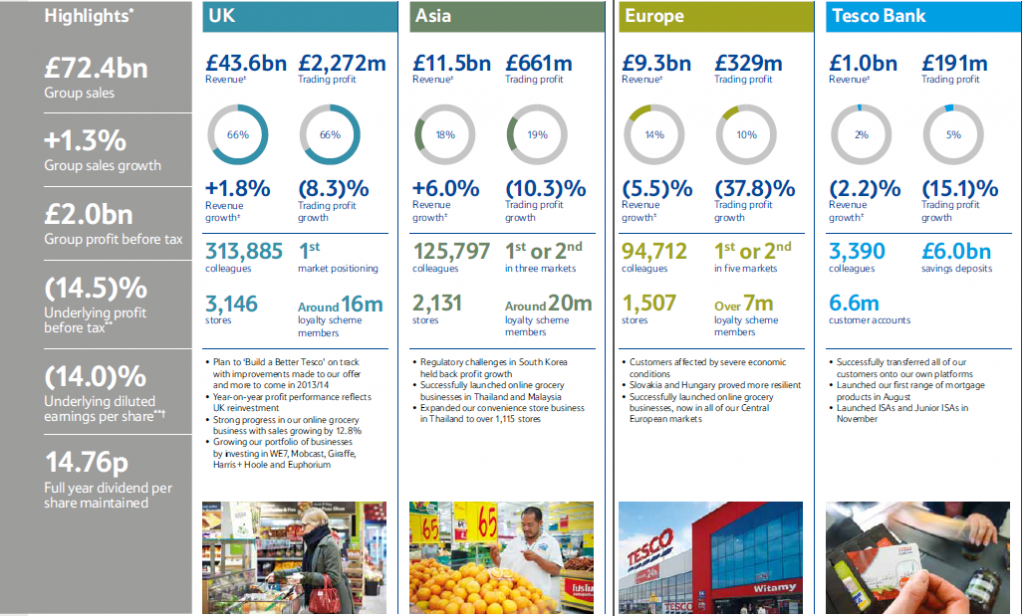

Having such an approach, it helps Tesco create value day by day. Its latest annual report reflects the progress the company has obtained in 2012-2013, through a series of Key Performance Indicators:

– Underlying profit before tax– 14.5% growth compared to the previous year;

– Total shareholder return (TSR)- measures the percentage change in the share price, plus the dividends paid and reinvested. The increase of the TSR, 22.5% compared to 2011-2012, for the one-year TSR and 2.1%, for the five-year TSR, reflects the effect on Tesco’s share price of increased investor confidence, since Tesco significantly investment in its customer offer in the UK;

– Net indebtedness– the ratio shows debt in relation to operating cash flow (EBITDAR), and it has risen, at approximately 3.2 times, despite a reduction in net debt. The cause was the decline in EBITDAR, driven by the investment in the UK, the regulatory impact in South Korea (which limited the opening hours) and challenging economic conditions, particularly in Central Europe;

– Gearing- measures the proportion of net assets financed through debt rather than equity, calculated as net debt divided by total equity. The ratio remained relatively flat, at 39.6% compared to 38.4% in 2011-2012, reflecting Tesco stable debt position and growing investment in assets;

– Capital expenditure (CAPEX) as % of sales- the rate shows the investment in property, plant and equipment, the investment property and intangible assets, divided by Group sales. In 2012-2013, Tesco reduced its rate of capital investment, at 4.1%, focusing on less capital-intensive investments with higher returns, most notably online and convenience;

– Fixed charge cover- measures the number of times the operating cash flow covers debt obligations. The ratio decreased to approximately 4 times, due to the decline in EBITDAR and rent increases.

Although not all indicators have seen their results increased, the predilection for investing in new markets and consolidating the existing ones, as well as the permanent interest for innovation, builds a sustainable growth, which will ensure Tesco solid future profits. Only in this way, can Tesco continue ‘working to make what matters better, together’.

References:

- Tesco (2013), Annual report: Working to make what matters better, together

- Tesco (n.d.), Vision and strategy

Tags: KPI, KPI in Practice, Retail performance, TESCO