Canada Revenue Agency’s road to performance

The Canada Revenue Agency (CRA) is the organization responsible for tax revenue collection and benefit administration. Its unique approach is the one that guides its path to performance:

- Providing exceptional services – to reduce the compliance burden and make sure taxpayers receive a qualitative support if needed;

- Securing compliance with the self-assessment system – to ensure that taxpayers fulfill their obligations in due time;

- Acting with integrity – to gain taxpayers’ confidence;

- Leading change through innovation – to further develop as an organization.

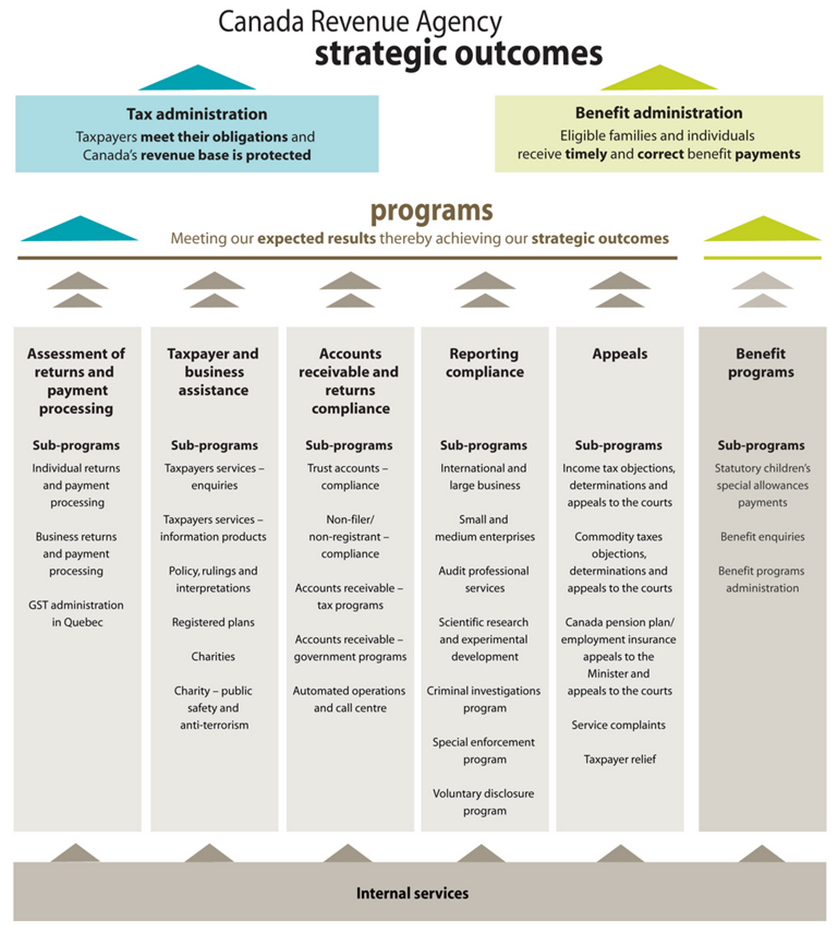

These priorities are translated into six programs meant to ensure that CRA’s strategic outcomes and plans are fulfilled. The architecture below presents more details about the programs and sub-programs the agency conducts in order to achieve an efficient tax and benefit administration.

Each year, CRA’s performance and the attainment of its strategic objectives are assessed. For example, in order to track if Canadians met their obligations, a number of Key Performance Indicators (KPIs) are used:

Each year, CRA’s performance and the attainment of its strategic objectives are assessed. For example, in order to track if Canadians met their obligations, a number of Key Performance Indicators (KPIs) are used:

- % Individuals who paid their reported taxes on time;

- % Individuals that filed their tax return on time;

- % Corporations with taxable income that filed their tax return on time;

- % Businesses registered for the GST/HST.

The target for the above KPIs was set at 90%, and the only indicator that did not reach it, for the period 2012-2013, was % Corporations with taxable income that filed their tax return on time, which reached a level of 85%.

Other relevant KPI that could be used to monitor performance in this direction include:

- % Tax collected on time – to indicate the percentage of successful tax collection on-time;

- $ Net cost of tax collection – to measure the amount of money spent from the local government budget during the reporting period, to finance the tax collection process;

- # Time to issue a business tax refund – to measure the average time elapsed from the date when the business tax return of refund application was received, to the date the finance department mails the check to the customer.

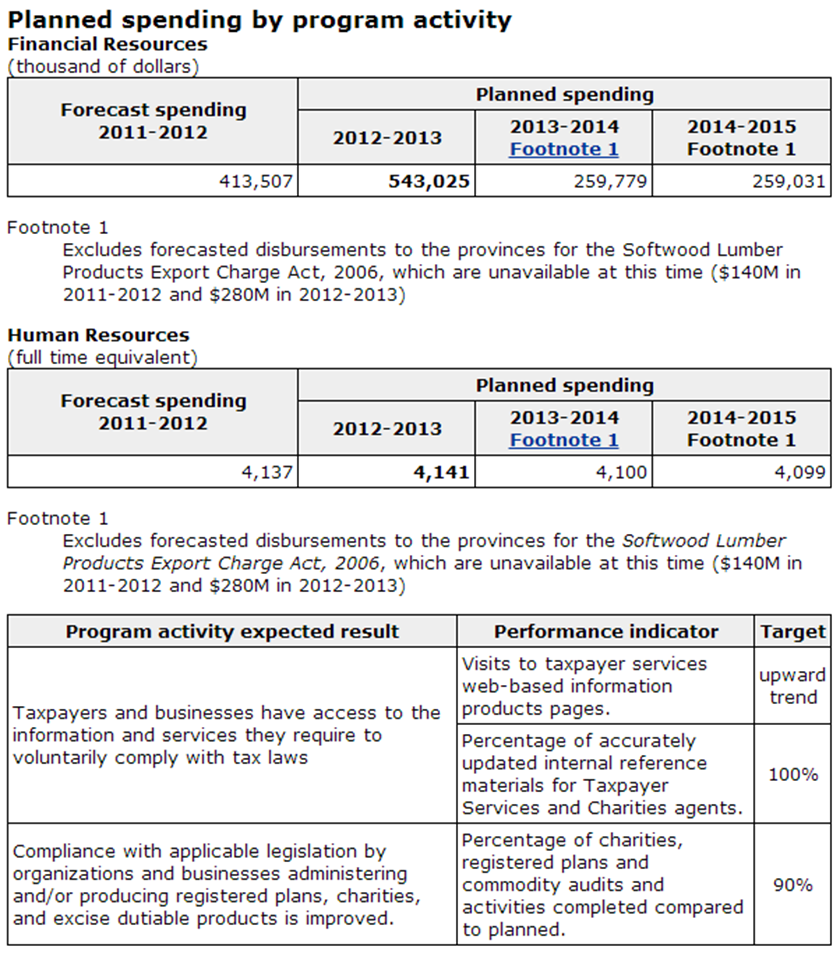

Moreover, each undertaken program is closely monitored, to track if its execution was within the allocated budget and if it delivered the expected outputs. The Report on Plans and Priorities is therefore a key component of how CRA manages its performance.

Relevant KPIs that can be used to monitor the extent to which the programs conducted were under the performance parameters set, include:

- % Project budget variance – to measure the deviation between the planned and the actual project cost upon completion;

- % Projects on time – to measure the percentage of projects completed according to the schedule, out of the total number of projects in the portfolio;

- % Project milestones missed – to measure the percentage of milestones missed during the project, out of the total number of project milestone;

- % Project resource utilization – to measure the percentage of resources dedicated for the project, expressed in man-hours that are actually used, out of the total resources allocated.

References:

- Canada Revenue Agency (2013), Departmental performance report 2012-13

- Canada Revenue Agency (2013), Report: Analysis of program activities by strategic outcome(s)

- The KPI Institute (2014), Project management KPIs

- The KPI Institute (2014), Budget and finance KPIs

Image sources:

- Adapted from Canada Revenue Authority

- Canada Revenue Agency (2013), Departmental performance report 2012-13

- Canada Revenue Agency (2013), Report: Analysis of program activities by strategic outcome(s)

Tags: Government - State / Federal performance, Performance in Canada, Performance Management